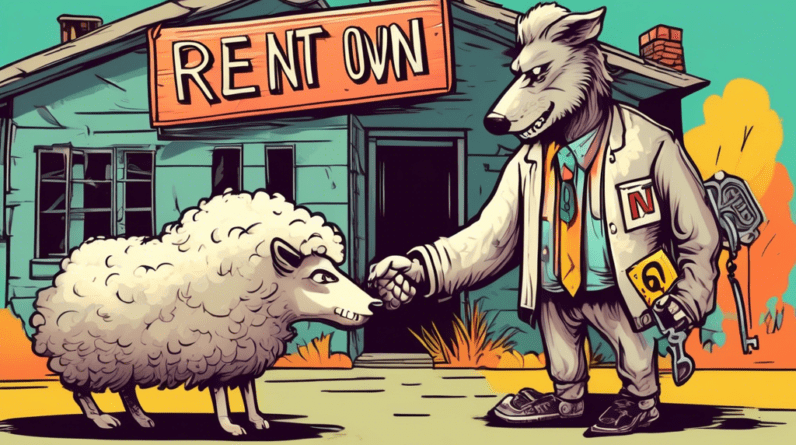

Rent-to-Own Scams: How to Protect Yourself

Understanding Rent-to-Own Agreements

Rent-to-own (RTO) agreements, also known as lease-purchase agreements, can seem like a viable path to homeownership, especially for those who face challenges qualifying for a traditional mortgage. In a typical RTO arrangement, you rent a property with the option to buy it later at a predetermined price. A portion of your monthly rent payment may go towards the eventual purchase, offering a way to build equity over time.

While legitimate rent-to-own agreements exist and can be beneficial, this type of transaction also attracts scammers looking to prey on unsuspecting individuals with the dream of owning a home. These scams can trap you in unfavorable contracts, lead to financial losses, and even result in eviction.

Common Rent-to-Own Scams to Watch Out For

Falling victim to a rent-to-own scam can have devastating consequences. Awareness is key to protecting yourself. Here are some prevalent scams and the red flags to watch out for:

1. The Hidden Ownership Scam

How it Works: The scammer poses as the homeowner or property owner but doesn’t actually own the property. They might be a renter themselves or have no legal claim to the property. You sign a rent-to-own agreement and make payments, believing you’re building equity, only to discover the true owner is someone else entirely.

Red Flags:

- The owner is evasive about providing proof of ownership or hesitates to show you the property title.

- They pressure you to sign the agreement quickly without proper vetting or legal advice.

- The deal seems too good to be true, with a suspiciously low purchase price or incredibly lenient terms.

2. The Deferred Maintenance Trap

How it Works: The property may appear to be in decent condition during initial viewings. However, the scammer, often the actual homeowner, has concealed significant underlying maintenance issues. As part of the agreement, you might be responsible for repairs, leaving you with costly and unexpected expenses.

Red Flags:

- The seller is reluctant to let you have the property professionally inspected.

- You notice signs of shoddy repairs or potential problems (water stains, mold, electrical issues) that are dismissed by the seller.

- The rent-to-own agreement places the full burden of repairs on you, even for pre-existing issues.

3. The Balloon Payment Scheme

How it Works: The rent-to-own contract includes a clause requiring a large lump-sum payment, known as a balloon payment, towards the end of the agreement term. This payment is often significantly higher than your regular installments and can be challenging to afford, potentially leading to a default and the loss of any equity you’ve built.

Red Flags:

- The contract uses complex legal language or obscure wording to disguise the balloon payment clause.

- There’s a lack of transparency about the total amount you’ll pay by the end of the agreement.

- The seller downplays the significance of the balloon payment or avoids discussing it in detail.

4. The Credit Repair Illusion

How it Works: Scammers may target individuals with poor credit history, promising that the rent-to-own agreement will help improve their credit score. However, the agreement might not be structured to report payments to credit bureaus, or the scammer might not follow through on their promise.

Red Flags:

- The seller offers guaranteed credit repair with no evidence or legitimate explanation of how it will be achieved.

- They ask for a large upfront fee or down payment specifically for credit repair services.

- The agreement lacks clarity on how and if payments will be reported to credit reporting agencies.

Protecting Yourself from Rent-to-Own Scams

While the potential for scams exists, rent-to-own can be a legitimate path to homeownership if you take the right precautions:

1. Thoroughly Research the Seller and Property

- Request proof of ownership: Ask to see the property title and verify the seller’s identity to ensure they are the legal owner.

- Search public records: Look up the property’s history, including past sales, liens, and any legal disputes.

- Check for complaints: Research the seller or company online for reviews, complaints, or any history of fraudulent activity.

2. Insist on a Professional Home Inspection

- Hire a qualified inspector: Don’t rely solely on the seller’s assurances. Engage a licensed home inspector to assess the property’s condition thoroughly.

- Address concerns in writing: Document any issues found during the inspection and get written agreement from the seller on repairs before signing the contract.

- Be wary of as-is clauses: While some minor repairs might be acceptable, avoid agreements where you’re solely responsible for significant pre-existing problems.

3. Review the Contract with a Real Estate Attorney

- Seek legal counsel: Don’t sign anything without having a real estate attorney review the contract thoroughly.

- Understand all terms and conditions: Ensure you comprehend the purchase price, payment schedule, responsibilities for repairs, and any contingencies or clauses that could impact you.

- Negotiate unfavorable terms: Don’t hesitate to negotiate or walk away from a deal if you’re uncomfortable with any part of the agreement.

4. Be Wary of Promises That Sound Too Good to Be True

- Question unrealistic offers: If the deal seems unbelievably good, there’s likely a catch. Be cautious of exceptionally low prices or overly lenient terms.

- Avoid high-pressure tactics: Don’t let anyone rush you into signing an agreement. Take your time, do your due diligence, and seek advice if needed.

- Trust your instincts: If something feels off or you have doubts, walk away. It’s better to be safe than sorry.

Rent-to-Own: Proceed with Caution and Informed Decisions

Rent-to-own can be a viable option, but it’s crucial to proceed with caution. By understanding the potential risks and following the steps outlined above, you can significantly reduce your chances of falling victim to a rent-to-own scam. Remember, knowledge is your best defense in the world of real estate transactions.